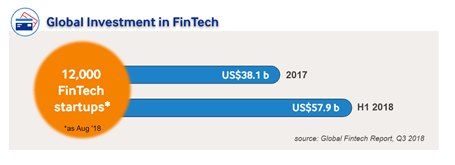

Financial Technology, or FinTech is the new technology and innovation that aims to compete with traditional financial methods in the delivery of financial services. The Banking, Financial Services and Insurance (BFSI) industry is being redefined with the evolution of FinTech. Despite being new, the growth rate is phenomenal and it is expected to remain so over the coming years.

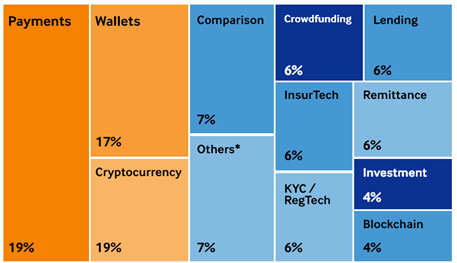

In Malaysia, payments, wallets, and cryptocurrency dominate the FinTech market, making up close to half of the market share.

It is also making presence in Malaysia, although still in its infancy. The rise of digital consumer also contributes to the growth of FinTech in Malaysia.

The are several factors driving the growth of FinTech in Malaysia

Robo-advisory is a platform where users input preferences, which are analysed to recommend the most suitable portfolio. This is done via an automated and algorithm-based allocation.

Bank deposits accounting for more than one third of total financial assets of Malaysians, indicating opportunities for new robo-advisory players to tap into this market.

The Securities Commission has also introduced the regulatory framework to facilitate Digital Investment Management, and with only one player currently in the Malaysian market, there is wide room for new players to come in. From 10,000 robo-advisory users in 2018 to have exponential growth to 60,200 robo-advisory users by 2022.

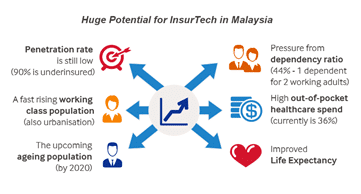

Insurance Technology, or InsurTech refers to the use of technology innovation with the purpose to reduce costs and create efficiency from the current traditional insurance industry practices.

The potential for the InsurTech is huge, where players can venture into the following areas:

Regulatory Technology, or RegTech can be described as the use of technology to facilitate and enhance compliance in regulated industries.

Currently, 45% of Malaysia Fintech startups says that it is difficult to conform to local regulators.

With RegTech, provides solutions to ensure that users are up to date with the changing regulatory requirements by providing technologically advanced solutions to the increasing demands of compliance within the financial industry.

It helps to effectively and efficiently analyse the regulatory environment using algorithm, AI and ML.

RegTech activities include:

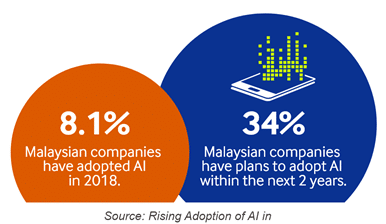

Artificial Intelligence (AI) is the creation of intelligent machines that perform various cognitive tasks such as speech recognition, learning, planning and problem solving.

Machine Learning (ML) is one application of AI which gives machines the ability to learn and adjust new information without being explicitly programmed or monitored.

Deep Learning (DL) is another application which uses ML techniques to imitate human decision-making.

Applications of AI technology in BFSI industry include:

Infographic View